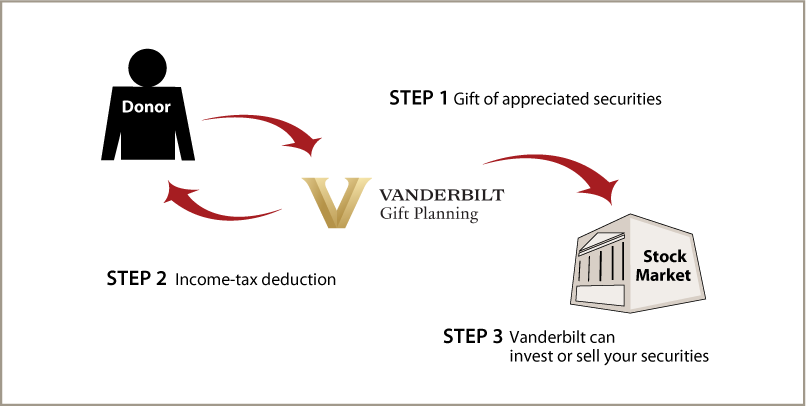

How It Works

- You can send unendorsed stock certificates by registered mail or instruct your broker to make the transfer from your account to our account

- You receive an income-tax deduction

- Vanderbilt may keep or sell the securities

Benefits

- You may receive a federal income-tax deduction for the full fair-market value of the securities

- You avoid long-term capital-gain tax on any appreciation in the value of the stock

- Your gift will support Vanderbilt as you designate

Special note: You should call or e-mail us to tell us of your intent, and we will be able to assist you with the details of the transfer.

Request an eBrochure

Which Gift Is Right for You?

Contact Us

Vanderbilt University

Office of Gift Planning

PMB 407756

2301 Vanderbilt Place

Nashville, TN 37240-7756

615-343-3113 or

Toll Free 888-758-1999

plannedgiving@vanderbilt.edu

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer