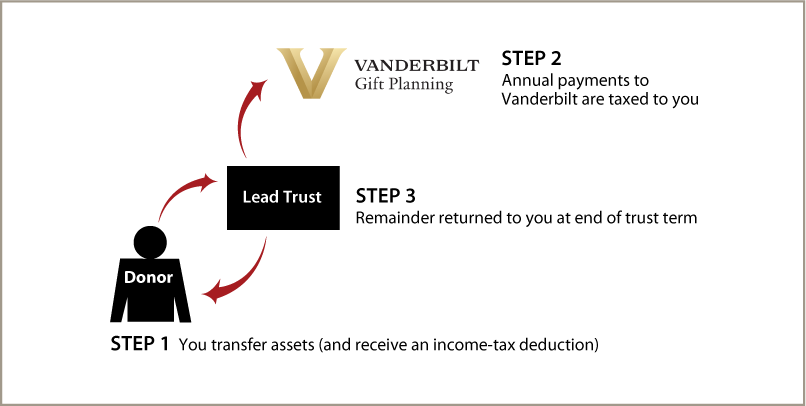

How It Works

- Create trust agreement stating terms of the trust (usually for a term of years), transfer cash or other property to trustee, and receive an income-tax deduction

- Trustee invests and manages trust assets and makes annual payments to Vanderbilt

- Remainder transferred back to you

Benefits

- Annual gift to Vanderbilt

- Property returned to donor at end of trust term

- Professional management of assets during term of trust

- Charitable income-tax deduction, but you are taxed on trust's annual income

Request an eBrochure

Request Calculation

Contact Us

Vanderbilt University

Office of Gift Planning

PMB 407756

2301 Vanderbilt Place

Nashville, TN 37240-7756

615-343-3113 or

Toll Free 888-758-1999

plannedgiving@vanderbilt.edu

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer